Portfolio Allocations Matter

October 5, 2023

If the events of 2022 and 2023 haven’t conveyed that portfolio allocations matter to investors, it’s challenging to imagine what kind of…

Explore articles on tax planning, investing, charitable giving, and more—from our advisors to you.

October 5, 2023

If the events of 2022 and 2023 haven’t conveyed that portfolio allocations matter to investors, it’s challenging to imagine what kind of…

August 24, 2022

Check out the recent Redfin article we were featured in: Build-to-Rent Homes: What You Need to Know About the Future of Single-Family…

June 6, 2022

As mortgage rates sit at decade record highs, it’s no surprise to see and hear countless ads on social media and the…

May 3, 2022

In striving for better performance, I often like to take a step back from the daily headlines to get a macro view…

February 11, 2022

In a world with constant information overload, sometimes it’s best to take a step back from financial news feeds to focus on core…

July 6, 2021

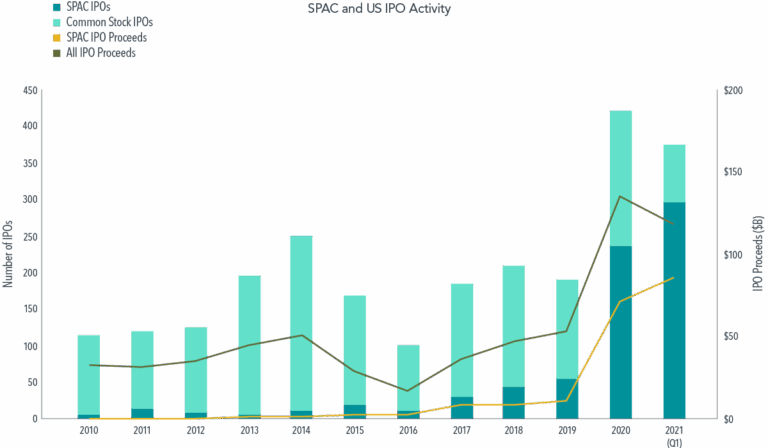

Investors are flooded with information, options, and little guidance when choosing what investment vehicles to put in their investment accounts. During and…

Experienced Advisors Committed to Guiding Your Financial Journey with Integrity.