Being bombarded with data and news headlines presented as impactful to your financial well-being can evoke strong emotional responses from even the most experienced investors. News headlines from the ”lost decade”1 can help illustrate several periods that may have led market participants to question their approach.

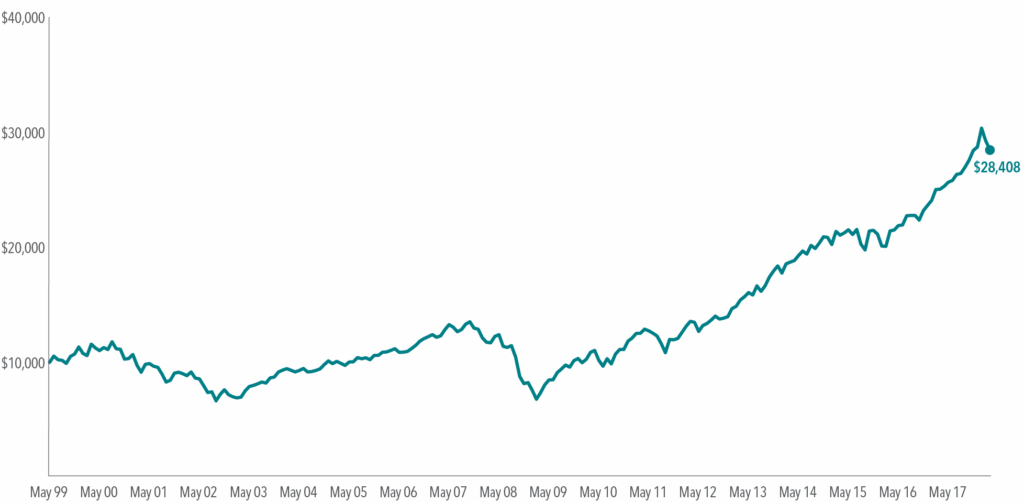

While these events are now a decade or more behind us, they can still serve as an important reminder for investors today. For many, feelings of elation or despair can accompany news headlines like these. We should remember that markets can be volatile and recognize that, in the moment, doing nothing may feel paralyzing. Throughout these ups and downs, however, if one had hypothetically invested $10,000 in US stocks in May 1999 and stayed invested, that investment would be worth approximately $28,000 today.2

When faced with short-term noise, it is easy to lose sight of the potential long-term benefits of staying invested. While no one has a crystal ball, adopting a long-term perspective can help change how investors view market volatility and help them look beyond news headlines.

Part of being able to avoid giving in to emotion during periods of uncertainty is having an appropriate asset allocation that is aligned with an investor’s willingness and ability to bear risk. Take our free risk assessment here. It also helps to remember that if returns were guaranteed, you would not expect to earn a premium. Creating a portfolio investors are comfortable with, understanding that uncertainty is a part of investing, and sticking to a plan may ultimately lead to a better investment experience.

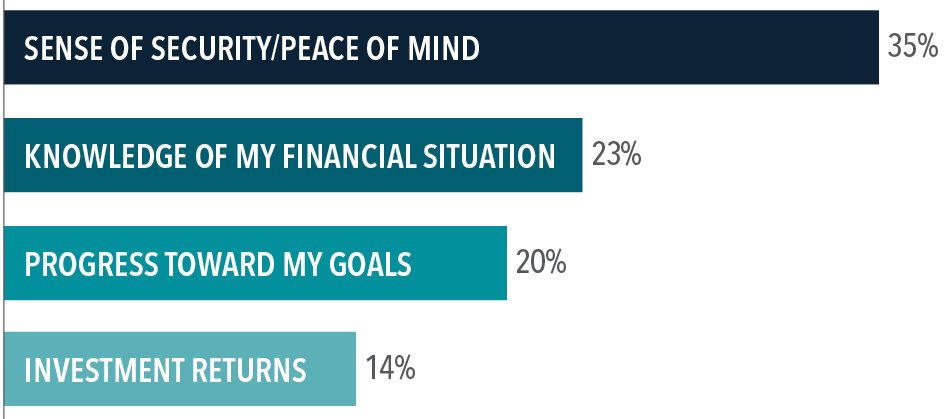

However, as with many aspects of life, we can all benefit from a bit of help in reaching our goals. The best athletes in the world work closely with a coach to increase their odds of winning, and many successful professionals rely on the assistance of a mentor or career coach to help them manage the obstacles that arise during a career. Why? They understand that the wisdom of an experienced professional, combined with the discipline to forge ahead during challenging times, can keep them on the right track. The right financial advisor can play this vital role for an investor. A financial advisor can provide the expertise, perspective, and encouragement to keep you focused on your destination and in your seat when it matters most. A recent survey conducted by Dimensional Fund Advisors found that, along with progress towards their goals, investors place a high value on the sense of security they receive from their relationship with a financial advisor.

Having a strong relationship with an advisor can help you be better prepared to live your life through the ups and downs of the market. That’s the value of discipline, perspective, and calm.

At Coastal Wealth Advisors, we believe that the right financial advisor plays a vital role in helping you understand what you can control while providing the expertise, perspective, and encouragement to keep you focused on your destination. That’s the difference the right financial advisor makes. If you find yourself more worried now than you have been in the past, give us a call; we’d love to sit down with you and learn about your unique life.

Experienced Advisors Committed to Guiding Your Financial Journey with Integrity.