The meaning of wealth isn’t necessarily defined solely by the dollars in our bank account or the value of our investments, but rather how those assets help us build memories with the people we love. There are rich people and wealthy people in life; the only difference being that wealth can be obtained without money. As your Johns Island Financial Advisor, we want you to experience everything life has to offer with the ones you love the most. Contact us today to set up an appointment!

Helping Parents with Finances

Discussing money with family quite often becomes uncomfortable for most people especially when helping parents with finances. If you think about your life, you probably realize that it wasn’t always that way. As a child and teenager, you were completely comfortable asking Mom and Dad for a few dollars every now and then. Perhaps even into your early 20s as you began your first job outside of college, asking for a little financial help wasn’t out of the norm.

At some point, it became expected of you to be self-sufficient. The age at which this occurs differs from one person to the next. But we can’t deny that we all need some help at different points throughout our lives. This is especially true for your Mom and Dad and you may find yourself helping parents with finances. We at Coastal Wealth Advisors understand that this can become a challenging task since your parents will likely resist your efforts. With this challenge in mind, we thought it was appropriate to pass on some advice to help you approach the subject with them.

Question: Why do we suggest you approach the subject of helping parents with finances?

Answer: We suggest you approach the subject of helping parents with finances because they won’t approach you. For your entire life, they’ve been your support system without fail, even when you no longer needed them to be. And for them to do otherwise goes against their natural parental instincts. There’s no denying that as our body ages, our minds also age. And with that, we can sometimes start to forget things and make poor judgement calls. It begins with simple tasks and can quickly progress to major things. Add to this vulnerability the numerous financial scams that unfortunately plague our society and your parents can find themselves a victim of fraudsters. So approaching your parents about helping them with finances is a proactive measure to prevent negative financial events from happening.

Three Fears of Helping Parents with Finances:

- Fear of Losing Control

As we age, loss of independence and control is a realistic fear that every individual will experience in their lifetime. Even though we all know that our life on Earth is limited, it’s a tough pill to swallow. It hurts to see our loved ones who were always so strong become the opposite. Your parents won’t give up control of their finances without a fight and we believe that they don’t have to give up control. There are specific ways to ease into helping parents with finances. A simple conversation about the subject in a non-intrusive manner can lighten the subject and allow your parents to open up. We suggest beginning with something like this:

“Mom and Dad, I was reading an online article at Coastal Wealth Advisors dot com about preparing for an unexpected death and it suggested that children have a conversation with their parents about what would happen in the event of an untimely death or injury to one of them. It talked about how oftentimes one parent doesn’t know where the financial information is since the other parent commonly took care of that. Do you guys have a simple file somewhere where all of your accounts and insurance documents are kept so that either of you know what to do if something were to happen?”

This type of question by itself won’t get you far since the answer is either yes or no. But following up with this question in response helps the process even further:

“Ok, that’s great that you have one. What happens, though, if something happens to the both of you at the same time? The article suggested having a trusted person, typically an adult child, be knowledgeable in that area of their life so that if something happened to both, another person would be able to handle the finances.”

By approaching it this way, you are easing into the conversation from the perspective of helping, not taking over. We’ve found that adult children who are aware of their parent’s financial situation are able to intervene during times of crisis much faster than those who aren’t; and timing can make all the difference into the severity of the crisis.

- Fear of Disclosing Finances

Money is a traditionally touchy subject that is not usually discussed between parents and their children. This is what we’re trying to change. As a parent, disclosing your finances to your child can open a Pandora’s box of problems. If your Mom and Dad’s financial situation is less than ideal (or what they perceive to be less than ideal) it may result in their embarrassment. On the flip side, if the parents are financially secure, the adult child can become inclined to ask for financial support. Feeling obligated to help their child; the parents could put their financial future in jeopardy by unnecessarily sacrificing their savings for their adult children. To help you address this fear, consider bringing it up in conversation.

“Mom and Dad, I know discussing your financial situation with me probably goes against what you stand for and you may feel either embarrassed by it or perhaps concerned that I’ll ask for help. That’s not my goal; I just want you to know that I’m here to offer my help when/if you need it. The article I was reading made reference to the fact that families who talk openly about money tend to be more fiscally sound and financially responsible than those that don’t. In fact, 6 out of 10 families have discussed their plans in details with their children. I’m not interested in every detail, but rather to know that you are secure before something were to happen to you. I’d rather be able to help you out now while you are willing and able rather than after a crisis when you aren’t.”

Disclosing every detail of their financial life is not as important as you being aware of a general feeling of their security. You don’t need to know how many shares of General Motors stock they own, what price they bought it at, and what it’s worth. But you should know that they have approximately X amount in retirement funds, Y amount in debt, have consistent and predictable income sources, adequate medical insurance coverage, up-to-date WILL, power of attorney, and health care directive, among other necessary items.

- Fear of Asking for Help

As we mentioned before, if you don’t start the conversation, there’s a good chance it won’t ever happen. Asking for help can make your parents feel vulnerable to judgement and make them feel like they are no longer capable of doing something that they’ve been doing for so long. The simple fact is that you don’t know what you don’t know until you know it. Ultimately, everyone needs a helping hand every once in a while and it’s important to remind your parents that you’re there to help them just as they did a phenomenal job helping you. Start the conversation this way:

“Mom and Dad, remember how you helped me with my first place after college and all of the times you gave me money when I asked you for help? I want you to know that your generosity over the years has become a major inspiration in the way I live my life…and I want you to know that I’m here to help you guys out as well. We all know that life is too short and all we want is for our loved ones to be physically, mentally, and financially healthy. Please know that you don’t have to fear asking me for help every now and then. Usually, more minds are stronger together than apart; you’re not going to be a burden. You’re mom and dad and I love you.”

When helping parents with finances, it’s important to remember that open communication is the key. Approaching these fears will be difficult, no doubt, but when you consider the advice we’ve given you and approach each with care and understanding of your parent’s position, you may find your conversations to go a lot smoother than you’d think. We’re here to sit down with you and your family to discuss the best financial plan for your family’s future. Contact us today to set up an appointment, so we can help you create a financial plan that fits best for you and your family.

Image Credit: Free Stock Photos

Effective Financial Planning

You’re going somewhere, but is ‘somewhere’ really where you want to be? Life is a journey and managing your money effectively helps it become magnificent. Effective financial planning is the means by which you craft a journey towards a known destination and then make adjustments along the way. We know it can be challenging. We’re a Charleston Financial Planner and we want to help you define your ‘somewhere’ and then chart a course to get there. Let’s talk today!

Understanding a Car Lease

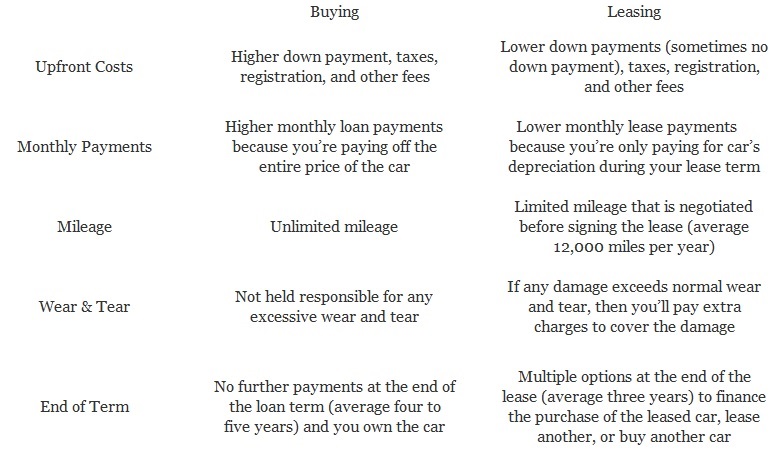

Purchasing a car is a sizeable financial decision that requires extensive thought and research. An alternative option to buying is leasing, but there are pros and cons to both choices. Understanding a car lease can by difficult and although the basic premise of a lease appears straight forward, there are many underlying complexities that can be deceiving to most people. Let’s dive into this debated topic in order to help you make a decision that’s best for you.

Leasing is just like renting; you pay each month to use the vehicle and do not own the car at the end of the contract. You’re obligated to fulfill your entire lease unless you’re willing to fork over a hefty early termination fee. Plus, you’re still required to perform necessary upkeep to the vehicle such as oil changes. These maintenance fees will usually be minimal during the length of your lease and most cars are still under warranties that cover major repairs. In addition to regular upkeep, you’re also held responsible for excessive wear and tear. At the end of your lease, if the dealership finds any damages that are more than normal wear, then you are responsible to pay extra charges.

The biggest limitation to any lease is the mileage cap. The average length of a car lease extends three years allowing 36,000 miles of driving throughout those years. If you exceed this mileage cap, there is a cost per mile for each mile you are over the limit. This cost is usually around 15 cents per mile. In most cases, you are able to arrange a lease with higher mileage with the dealership, but it will result in more expensive monthly payments.

Although many of these limitations may sound overwhelming, remember that you shouldn’t be afraid to negotiate! Contrary to what some people believe, leasing prices are not set in stone and are not the same at all dealerships. The key to understanding a car lease is shopping around and doing your research – SEE INSIDER TIP BELOW. This will give you the upper hand when negotiating, because the salesperson will know you have other (and possibly better) options. Approaching a lease using these tactics will help you get the best leasing option available.

INSIDER TIP: Shop for a Lease Based on Residual Value

- Residual value = the price at which you can buy the car at the end of the lease

- Residual value directly affects month payment cost

- Higher residual value = lower monthly payments

- Ultimately, lease a vehicle that holds its value

Although, leasing a car is the least expensive option in the short run with lower down payments and monthly costs, it is not the best choice for everyone. Consider your type of lifestyle when making this decision. For example, do you drive an hour to work every day or do you have young children that may damage the car’s interior? In these cases, leasing a vehicle may not be for you, but just remember to do your research and never be afraid to negotiate to ensure that you get the best deal possible. We’re a Johns Island Financial Advisor and are here to help you analyze your lifestyle and give you confidence in your financial decisions. Please contact us today to set up a complimentary appointment and we can discuss a plan of action that satisfies your needs!

Image Credit: Wikimedia

Living On A Budget

Living on a budget doesn’t mean eating Ramen noodles. A well defined, planned, and tailored budget is your way of navigating your financial life. But don’t just list your income and expenses in a boring format. Add cool line-items, pictures, and animation in there that are fun and unique to you. We’ve helped clients build budgets that include items like “ef it all, I want that!” and “future wife expense” among others. Don’t make budgeting into this giant mountain when it’s really a mole hill. And budgeting isn’t just for your parents, think of it as the reason they have money. Living on a budget is simply a structure for where you’re going to spend your money next month – if it’s spent on gourmet dining, so be it, just budget for you.

Need some guidance and help putting your budget together? Get in touch with us. We love putting together unique things.