Low cost index funds are an innovative solution for investors that provide diversified investments at low fees. On any given day, an investor can observe the performance of indices from providers such as MSCI,1 S&P,2 or Russell3—and that means it’s easy to monitor whether or not an index fund manager replicated the index’s performance (gross of fees and expenses). However, an index fund manager’s strict adherence to an index comes at a cost in the form of reduced discretion around trading.

Most indices revise their list of index constituents periodically (e.g., annually or quarterly), at which time securities may be added or deleted from the index. This process is commonly referred to as index reconstitution. For example, the annual reconstitution of the widely tracked Russell indices will occur on June 24, 2016. Russell index fund managers will need to buy additions and sell deletions for the indices they track in order to minimize tracking error4 relative to the index. Any deviation of the fund from the index, over days or even hours, could result in different returns from the index.

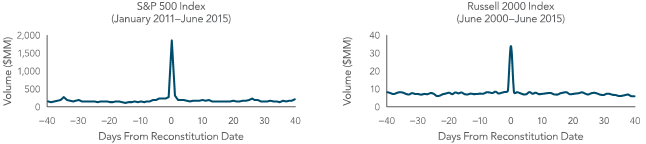

The effect on volume from index rebalance trades is apparent in a huge volume spike on trade reconstitution day. Exhibit 1 illustrates average trade volume for additions and deletions in four major indices during the 80-day period surrounding reconstitution. Each of the charts shows a marked increase in trade volume on the effective date of reconstitution relative to the surrounding days. The effect is pervasive across the market capitalization spectrum as well as geographic region.

Exhibit 1: Equal-Weighted Average Trade Volume for Index Additions and Deletions

S&P data provided by StanS&P data provided by Standard & Poor’s Index Services Group. Russell data © Russell Investment Group 1995-2016. MSCI data © MSCI 2016, all rights reserved.

For each index, this large liquidity demand tends to drive up the prices of securities with greater purchase demand (generally additions to the index) relative to the other securities in the index. It also tends to push down prices of securities with greater sell demand (generally deletions from the index) relative to the other securities in the index. Thus, for an index being tracked by a large amount of assets, the index has generally added securities at higher prices and deleted securities at lower prices than it would have if no assets had been tracking it. This phenomenon is the result of low cost index fund managers’ demanding liquidity on or around the index reconstitution date.

After the reconstitution of an index, as the liquidity demands of low cost index fund managers decline, research shows this price effect tends to reverse. That is, additions tend to underperform the index while deletions tend to outperform. As a result, low cost index fund managers’ implicit trading costs can result in a performance drag on the index and, consequently, low cost index funds tracking the index.

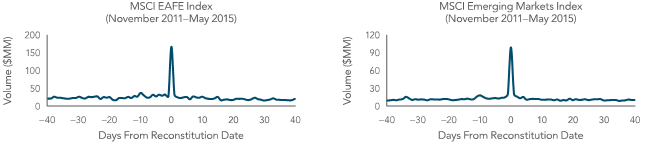

A simple experiment in delaying reconstitution allows us to estimate how much this price pressure has impacted index performance. Exhibit 2 compares average monthly returns for two sets of Russell indices; one set is rebalanced on the June-end reconstitution date and the other three months later. As shown in the final three columns, delaying rebalancing improved average returns between 0.15% and 0.73% per month from July through September—the three months between the rebalance date of the standard indices and their delayed counterparts. For all calendar months, including October through June when holdings are identical for both rebalancing methods, this amounts to a performance benefit ranging from 0.04% to 0.18% per month, or approximately 0.45% to 2.21% per year.

Exhibit 2: Effect of Delaying Reconstitution Month

Russell data © Russell Investment Group 1995–2016, all rights reserved. Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

Low Cost Index Funds: Summary

Low cost index funds may be a good option for investors seeking investments with low fees. However, in an attempt to match the returns of an index, a low cost index funds manager sacrifices trading flexibility. Because of high liquidity demands around index reconstitution dates, low cost index funds may incur high trading costs that do not appear in expense ratios but do affect net returns. The funds’ goal of minimizing tracking error may come at the expense of returns. Investors should consider the total costs, both in terms of expense ratio and trading costs, when evaluating investment options. Working with our Johns Island Investment Advisor can help you build a low cost portfolio using non-index funds in favor of evidence-based portfolios. Give us a call for a free consultation today!

- Morgan Stanley Capital International.

- Standard & Poor’s Index Services Group.

- FTSE Russell is wholly owned by London Stock Exchange Group.

- Tracking error is the standard deviation of the return differences between a fund and its benchmark

- Source: Dimensional Fund Advisors LP.