Next month, we head to the polls to elect the next president of the United States. Unless you don’t watch the news or spend time on social media, you know how heated this presidential election cycle has become. While the outcome is unknown, one thing is for certain: there will be a steady stream of opinions from pundits and prognosticators about how the election will impact the stock market, and thus your investment and retirement portfolio. As we explain below, investors would be well‑served to avoid the temptation to make significant changes to a long‑term investment plan based upon these sorts of predictions.

SHORT-TERM TRADING AND PRESIDENTIAL ELECTIONS RESULTS

Trying to outguess the market is often a losing game. Current market prices offer an up-to-the-minute snapshot of the aggregate expectations of market participants. This includes expectations about the outcome and impact of presidential elections. While unanticipated future events—surprises relative to those expectations—may trigger price changes in the future, the nature of these surprises cannot be known by investors today. As a result, it is difficult, if not impossible, to systematically benefit from trying to identify mispriced securities. This suggests it is unlikely that investors can gain an edge by attempting to predict what will happen to the stock market after any presidential elections.

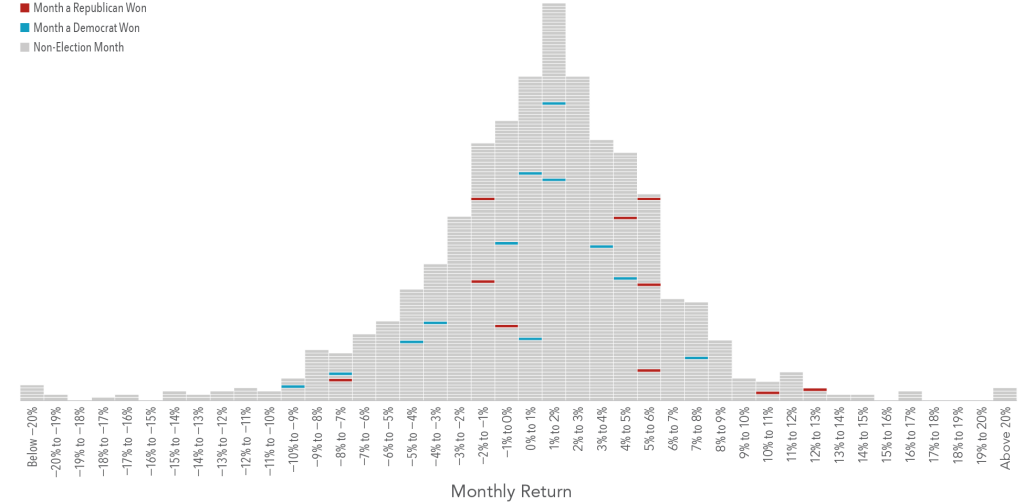

Exhibit 1 shows the frequency of monthly returns (expressed in 1% increments) for the S&P 500 Index from January 1926 to June 2016. Each horizontal dash represents one month, and each vertical bar shows the cumulative number of months for which returns were within a given 1% range (e.g., the tallest bar shows all months where returns were between 1% and 2%). The blue and red horizontal lines represent months during which presidential elections were held. Red corresponds with a resulting win for the Republican Party and blue with a win for the Democratic Party. This graphic illustrates that election month returns were well within the typical range of returns, regardless of which party won the presidential elections.

Exhibit 1: Presidential Elections and S&P 500 Returns, Histogram of Monthly Returns, January 1926 — June 2016

LONG-TERM INVESTING: BULLS & BEARS ≠ DONKEYS & ELEPHANTS

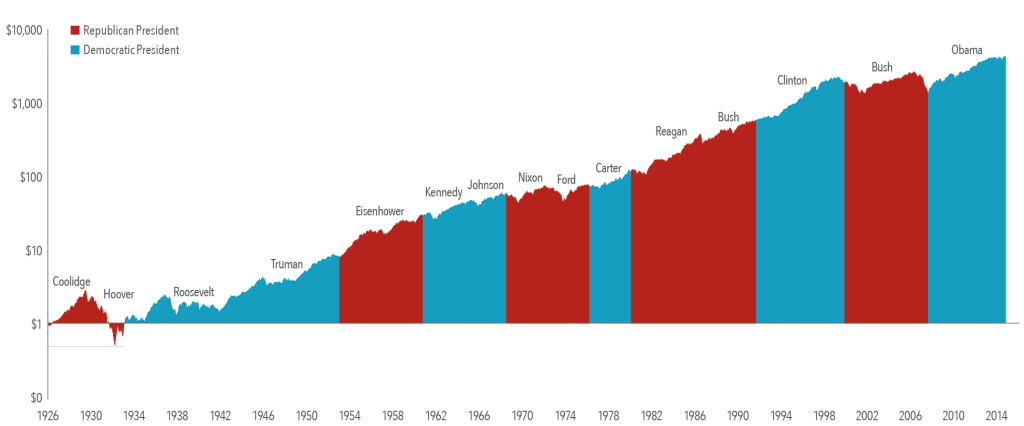

Predictions about presidential elections and the stock market often focus on which party or candidate will be “better for the market” over the long run. Exhibit 2 shows the growth of one dollar invested in the S&P 500 Index over nine decades and 15 presidencies (from Coolidge to Obama). This data does not suggest an obvious pattern of long-term stock market performance based upon which party holds the Oval Office. The key takeaway here is that over the long run, the market has provided substantial returns regardless of who controlled the executive branch.

Exhibit 2: Growth of a Dollar Invested in the S&P 500, January 1926–June 2016

Past performance is not a guarantee of future results. Presidential Elections. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. The S&P data is provided by Standard & Poor’s Index Services Group.

CONCLUSION

Equity markets can help investors grow their assets, but investing is a long-term endeavor. Trying to make investment decisions based upon the outcome of presidential elections is unlikely to result in reliable excess returns for investors. At best, any positive outcome based on such a strategy will likely be the result of random luck. At worst, it can lead to costly mistakes. Accordingly, there is a strong case for investors to rely on patience and portfolio structure, rather than trying to outguess the market, in order to pursue investment returns.

We perform a wide range of services for our clients outside of building, managing, monitoring, and rebalancing investment portfolios. One of the most important of these services, in our opinion, is the conversation we have surrounding behavioral finance, risk tolerance, and their impact on emotional decision making. As you can see by this post, we always turn to “the data” to help guide our advice. If you’re working with a financial advisor today who has positioned your portfolio to try to outguess the presidential elections, give us a call. We’re confident that our approach makes for a more positive investment experience.

1. Content written by Dimensional Fund Advisors, LP with edits by Coastal Wealth Advisors, LLC.