Diversification has been called the only free lunch in investing, so what’s the alternative?

This idea is based on research showing that diversification, through a combination of assets like stocks and bonds, could reduce volatility without reducing expected return or increase expected return without increasing volatility compared to those individual assets alone. Many investors have taken notice, and today, highly diversified portfolios of global stocks and bonds are readily available to investors at a comparatively low cost. A global stock portfolio can hold thousands of stocks from over 40 countries around the world, and a global bond portfolio can be diversified across bonds issued by many different governments and companies and in many different currencies.

Some investors, in search of additional potential volatility reduction or return enhancement opportunities, may even try to extend the opportunity set beyond stocks and bonds to other assets, many of which are commonly referred to as “alternative investments.” The types of offerings labeled as alternative investments today are wide and varied. Depending on who you talk with, this category can include, but is not limited to, different types of hedge fund strategies, private equity, commodities, and so on. These alternative investments are often marketed as having greater return potential than traditional stocks or bonds or low correlations with other asset classes.

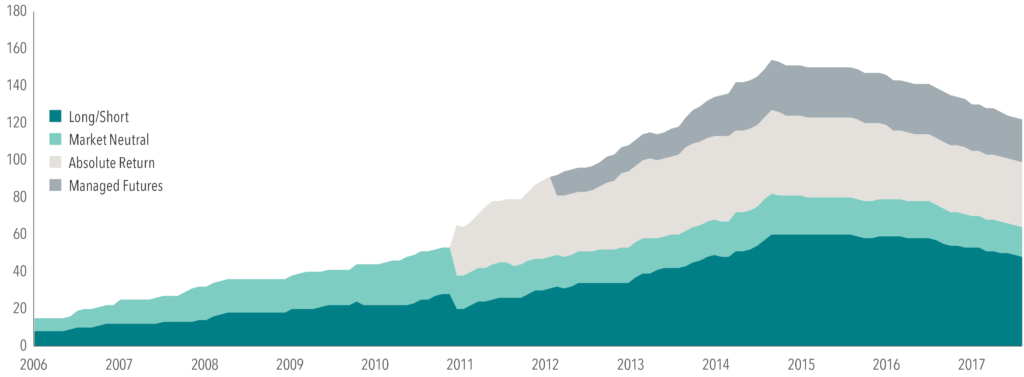

In recent years, “liquid alternative investments” have increased in popularity considerably. This sub-category of alternative investments consists of mutual funds that may start from the same building blocks as the global stock and bond market but then select, weight, and even short securities1 in an attempt to deliver positive returns that differ from the stock and bond markets. Exhibit 1 shows how the growth in several popular classifications of liquid alternative investments mutual funds in the US has ballooned over the past several years.

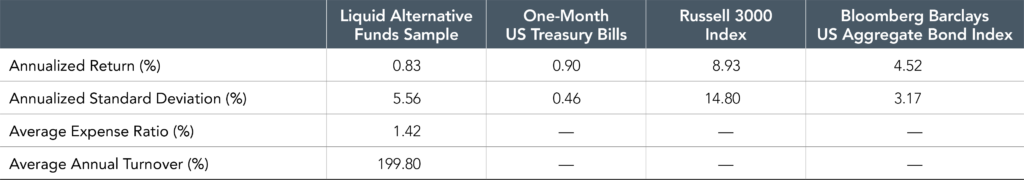

The growth in this category of funds is somewhat remarkable given their poor historical performance over the preceding decade. Exhibit 2 illustrates that the annualized return for such strategies over the last decade has tended to be underwhelming when compared to less complicated approaches such as a simple stock or bond index. The return of this category has even failed to keep pace with the most conservative of investments. For example, the average annualized return for these products over the period measured was less than the return of T-bills but with significantly more volatility.

While expected returns from such strategies are unknown, the costs and turnover associated with them are easily observable. The average expense ratio of such products tends to be significantly higher than a long-only stock or bond approach. These high costs by themselves may pose a significant barrier to such strategies delivering their intended results to investors. Combine this with the high turnover many of these strategies may generate and it is not challenging to understand possible reasons for their poor performance compared to more traditional stock and bond indices.

This data by itself, though, does not warrant a wholesale condemnation of evaluating assets beyond stocks or bonds for inclusion in a portfolio. The conclusion here is simply that, given the ready availability of low cost and transparent stock and bond portfolios, the intended benefits of some alternative investments strategies may not be worth the added complexity and costs.

CONCLUSION

When confronted with choices about whether to add additional types of assets or strategies to a portfolio for diversification beyond stocks, bonds, and cash it may help to ask three simple questions.

- What is this alternative getting me that is not already in my portfolio?

- If it is not in my portfolio, can I reasonably expect that including it will increase expected returns or reduce expected volatility?

- Is there an efficient and cost-effective way to get exposure to this alternative investments asset class or strategy?

If investors are left with doubts about any of these three questions it may be wise to use caution before proceeding. Our financial advisors can help investors answer these questions and ultimately decide if a given strategy is right for them. Have questions or want to find out if alternative investments are right for your portfolio and financial goals? Get in touch today.

ALTERNATIVE INVESTMENTS STRATEGY DEFINITIONS

Absolute Return: Funds that aim for positive return in all market conditions. The funds are not benchmarked against a traditional long-only market index but rather have the aim of outperforming a cash or risk-free benchmark.

Equity Market Neutral: Funds that employ portfolio strategies that generate consistent returns in both up and down markets by selecting positions with a total net market exposure of zero.

Long/Short Equity: Funds that employ portfolio strategies that combine long holdings of equities with short sales of equity, equity options, or equity index options. The fund may be either net long or net short depending on the portfolio manager’s view of the market.

Managed Futures: Funds that invest primarily in a basket of futures contracts with the aim of reduced volatility and positive returns in any market environment. Investment strategies are based on proprietary trading strategies that include the ability to go long and/or short.

Category descriptions are based on Lipper Class Codes provided in the CRSP Survivorship bias-free Mutual Fund Database.

- A short position is the sale of a borrowed security. Short positions benefit if the borrowed security falls in value.

- Written by Dimensional Fund Advisors, LP with edits by Coastal Wealth Advisors, LLC.

- Top image credit: InvestmentZen